You can support St. Mary Medical Center with a gift that doesn’t impact your cash flow, lifestyle or family security.

- Gifts from your will or trust

- Your assets remain in your control during your lifetime.

- You can modify your gift to address changing circumstances.

- Under current tax law there is no upper limit on the estate tax deduction for your charitable bequests.

Here is some suggested language that you can share with your personal advisors to include St. Mary Medical Center Foundation:

I give and bequeath to the St. Mary Medical Center Foundation, a California not-for-profit corporation, the sum of $______ dollars {or all the rest, residue, and remainder of my estate} to be used for the general purposes of the Hospital, in the discretion of its Board of Trustees. St. Mary Medical Center Foundation's Tax ID number is 23-7153876. Our official address is: St. Mary Medical Center Foundation, 1050 Linden Ave, Long Beach, CA 90813.

Need more information? Please contact the Foundation office at 562-491-9225 or supportstmarylb@commonspirit.org.

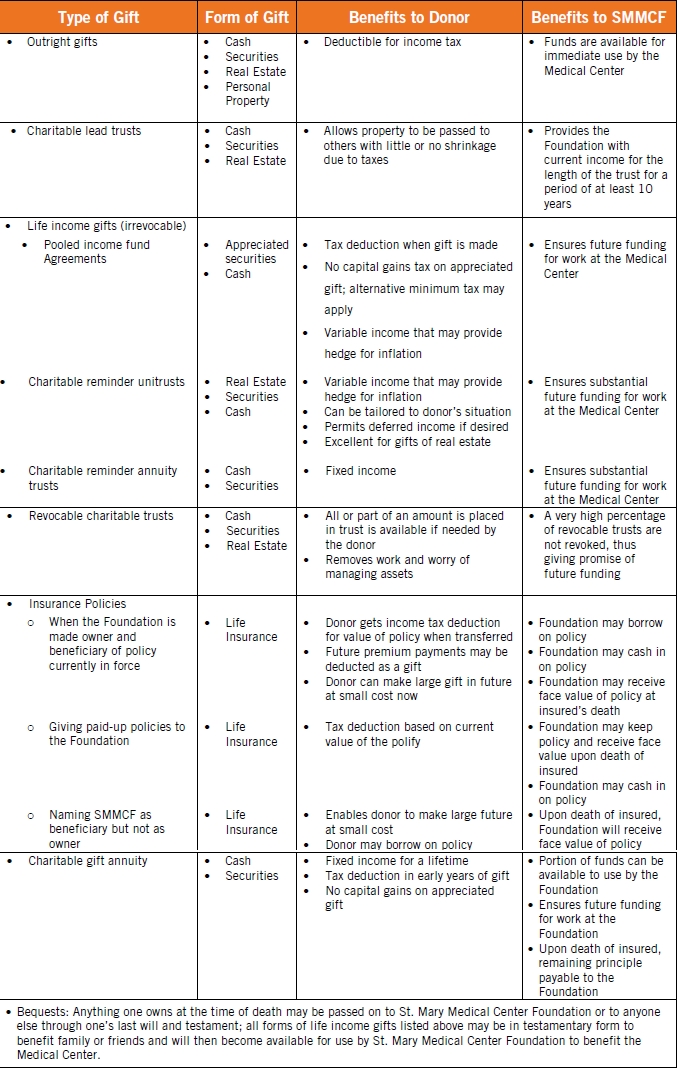

Planned Gift Vehicle Comparisons